Get a Loan Backed with Your BitcoinAffordable. Secure. Simple. Unlock your Bitcoin’s value without having to sell.

Each loan is Bitcoin backed, meaning we don’t need to run a credit check. You can pay off your loan whenever you want, or you can continue to pay monthly.

Wealthy Credit Limited automatically calculates repayment amounts for you. For example, to get 100,000 EUR with a Loan-to-Value (LTV) ratio of 65%, you’ll need to deposit ~16 BTC. All the payment history and details available at your customer cabinet.

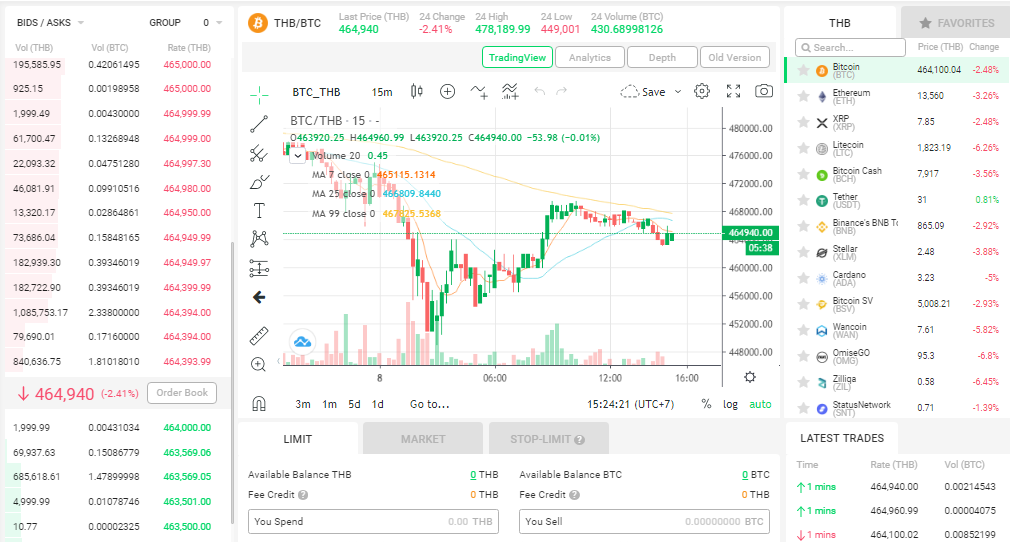

Loan on crypto currency also means that we can help you exchange your cash money to crypto currency (BTC or other) at our secure trade platform to help you yield double. You no longer have to worry about bank interest AND you can borrow double (contact us for your individual conditions) of the deposited cash.

Control Over Your BTC

Borrowers can free up excess collateral from an active loan. Also, you can add more Bitcoin to secure the loan better and avoid a margin call. As soon as your loan is repaid, you get your Bitcoins back.

Loan to Value (LTV) and margin

-

Loan-to-Value (LTV) refers to a ratio between your loan amount and collateral market value.

-

Lower LTV means you have a safety bag. In case of a market fall, your crypto is not likely to be liquidated to secure a lender’s investment.

-

Higher LTV means that you will have to act fast in case of an extraordinary market situation.

-

In case of critical changes in your cryptocollateral value, you’ll get an email notification.

-

In this case, you can repay the loan or add extra collateral. If you do nothing and the situation is a matter of necessity, your cryptoassets will be sold